Intelligent School Bus Tracking Solution

A holistic solution to address school bus tracking and monitoring needs

Real-time School Bus Tracking for Parents

Easy access to your child's school bus location with real-time ETAs

Bus Management and Maintenance for Operators

Maintenance reports, insights on fuel consumption and engine health, for better management

Driver Behavior Management

Insights and reports on vehicle speeding patterns, braking patterns, and parking times

Wide-range Compatibility and Easy Setup

Seamlessly connect with existing Geotab hardware for customized requirementsImproved Student Safety and Security

ZenBus helps parents monitor the location of a school bus in real-time, and sends alerts based on events such as bus arrivals on selected stops. Our solution also provides NFC-assisted attendance tracking of children when entering and departing the bus by sending alerts to parents with scan details.

Request a quote

Get a demo

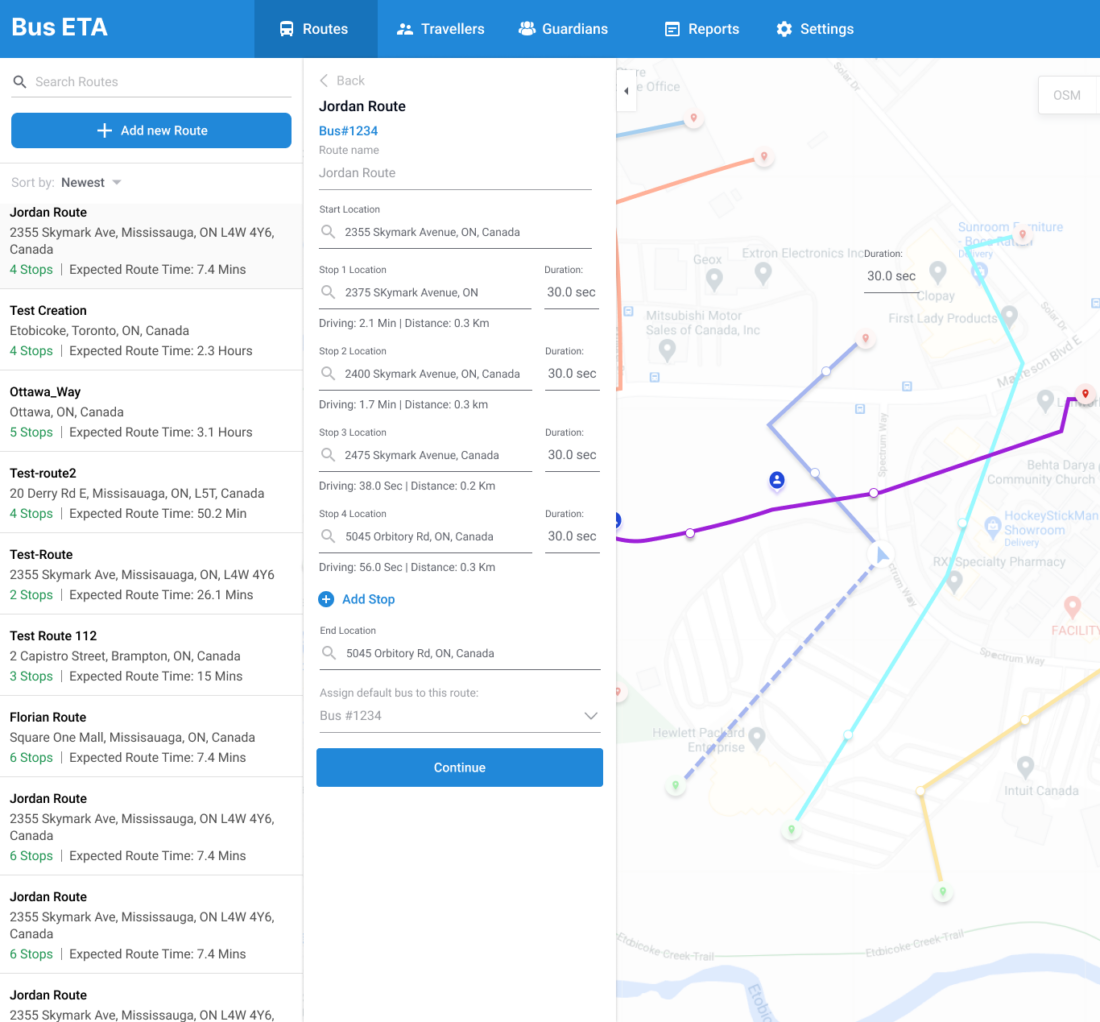

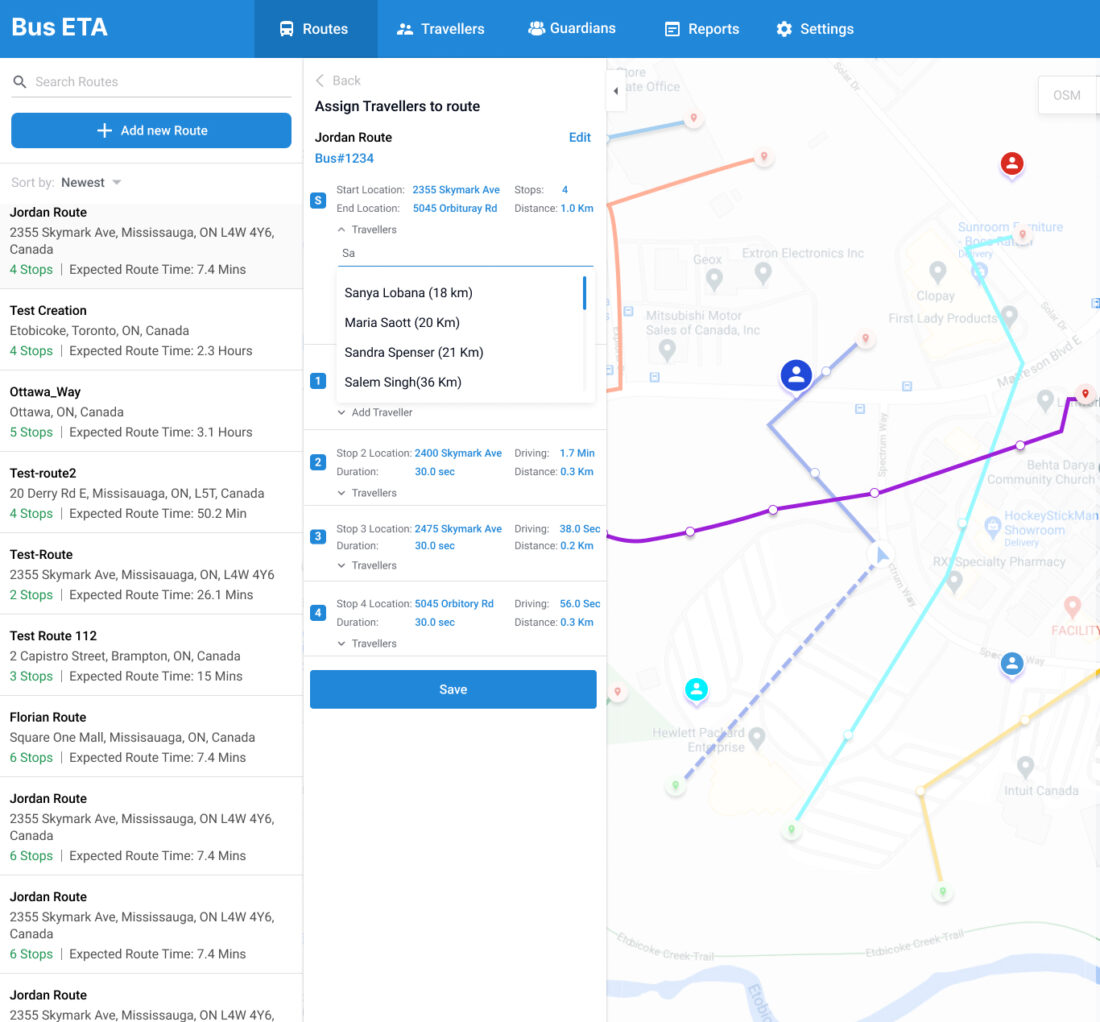

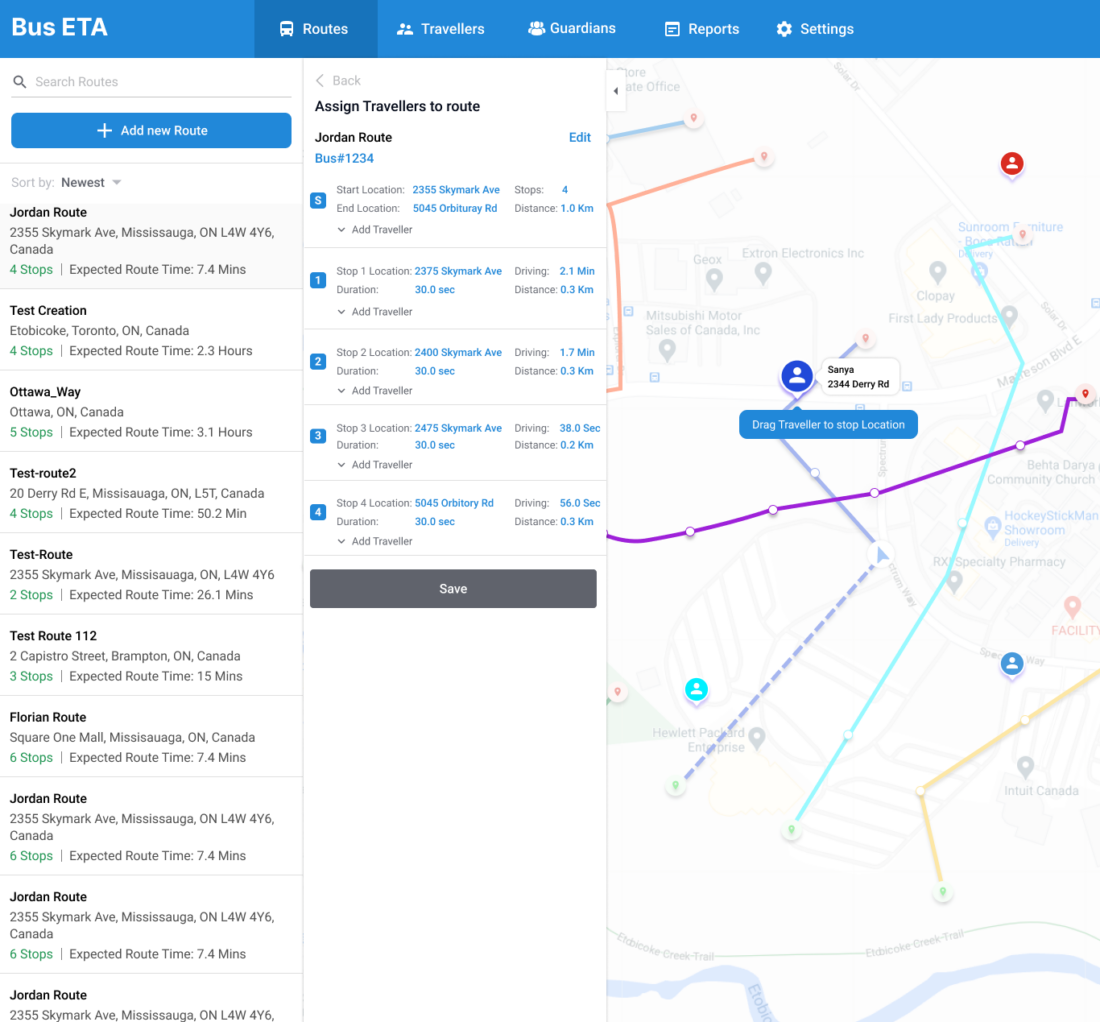

Dynamic Route Configuration for Efficient Routing

ZenBus enables fleet operators to easily create routes while allowing them to add and remove stops to see the impact on travel. With the help of historical data from a particular route, stakeholders can analyze and plan the best routes to save time and fuel.

Request a quote

Get a demo

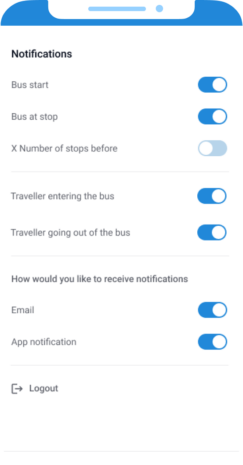

Dedicated Parent App for Arrival and Departure Monitoring

Parents can use the ZenBus app to monitor the live location of their child’s school bus and the expected arrival time. They can also receive notification alerts about any route deviation, in-bus attendance tracking of their children, helping them avoid unnecessary wait times and delays.

Request a quote

Get a demo

Scalable and Cost-saving

ZenBus seamlessly connects with an existing hardware infrastructure, helping school management and fleet operators keep costs down. It empowers fleet operators to achieve valuable insights and data around vehicle mileage, fuel consumption, route optimization, idling, and driving behaviours, all of which help school management improve fleet uptime and reduce maintenance costs.

Request a quote

Get a demo

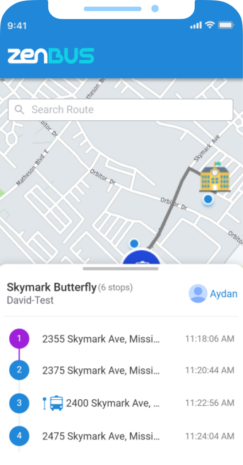

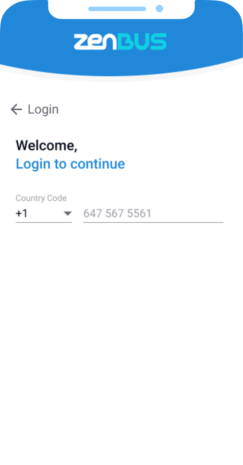

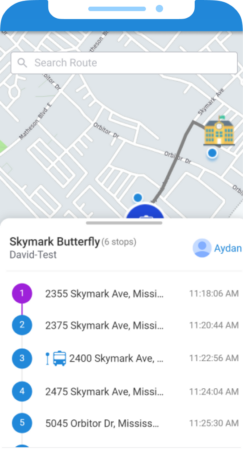

ZenBus APP In Use

We have to show the mobile snapshots of the solution, right from log in to, select bus, Tracking activity and Alerts

NUMBER AND OTP BASED lOGIN

SEARCH BAR

Customize your search by name of the stop or routeMAP VIEW

Real time view of the bus location on the mapROUTE NAME

View the name and details of the route.

SEARCH BAR

Customize your search by name of the stop or routeMAP VIEW

Real time view of the bus location on the mapSTOP DETAILS

View the name and details of the stops along the routes.